iServeU is one of the leading fintech providers in India. It enables local retailers and distributors to offer Digital financial services like DMT portal for cash deposits, cash withdrawal, banking enquiry, bill payment, Aadhar enabled payment via AePS portal, airtime recharge and micro ATM (micro ATM portal). Now one can access multiple banking services with the platform offered by iServeU.

Powering Ambitions, Powering Growth!

Read MoreA fully integrated neo banking platform

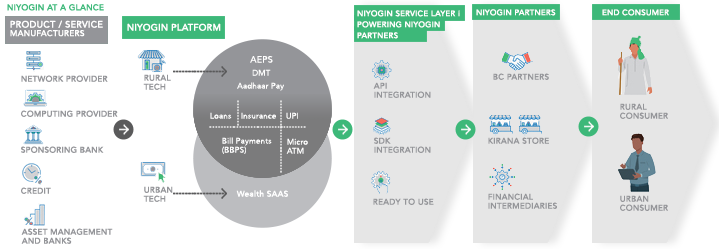

We are India’s unique early-stage public-listed fintech company committed to delivering impact-centric solutions and building the “Neobank” platform infrastructure to power MSME's through Rural, Urban and Wealth Tech using our partnership led model.

Company Overview

niyogin is the brainchild of two friends – Amit Rajpal and Gaurav Patankar. India has a conducive atmosphere for small businesses to thrive in but lacked a platform that could understand, support and therefore, enhance the potential of these businesses across domains. To support and empower these small businesses, niyogin was born.

Sanskrit word for “empowerment” niyogin was incorporated with a deep understanding of real daily problems of small businesses. The vision of niyogin is to have a substantial impact on the lives of small businesses by giving them solutions that leverage the power of technology and the confidence of an integrated network of partners.

With technology-first approach, niyogin is a holistic platform embracing the entire rural to developing urban MSME landscape providing financial inclusion, credit, investments, and SAAS services on the foundation of a unique partner led phygital distribution network.

SOLUTIONS

niyogin aims to create a digital platform that is a one-stop shop to meet the financial and non-financial needs of MSME’s.

Rural Tech

KNOW MORE

Urban Tech

APPLY NOWOur aggregator platform provides easy, fully digital credit access to MSME’s through a large distribution network of financial professionals serviced by product partners (banks & NBFC’s). Our product stack includes unsecured working capital loans, transaction centric short duration and secured loans

Wealth Tech

KNOW MOREPowered by InvestDirect – A direct-to-individual digital platform for Wealth Advisory and Analytics

An investment platform that offers financial advisory services to its clients via a comprehensive portfolio approach using a fully automated and paperless platform. Moneyfront uses a smart algorithm to profile the client and suggests the best Direct Plan suited to the investors’ persona.

Leadership Thoughts

The Niyogin Story - A quick chat with our CEO

Discussion on Financial Inclusion with our CEO : Empowering MSMEs in Bharat

Partner with Us

PARTNER WITH US

Niyogin Feed